44+ rental property mortgage interest deduction

Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

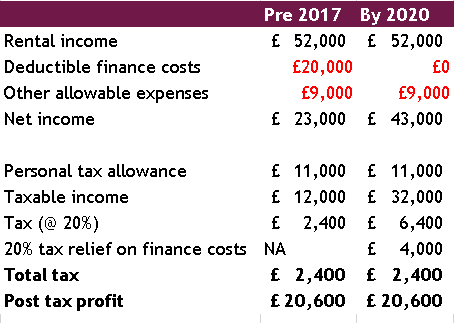

Buy To Let Mortgage Interest Tax Relief Explained Which

Web What Deductions Can I Take as an Owner of Rental Property.

. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Tenants pay 30 of unit rent OR of their income whichever is greater. If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return.

Web Up to 96 cash back Rental property. Web Also the TCJA lowered the cap on mortgage interest deductions from 1 million to 750000 for married couples filing jointly and from 500000 to 375000 for. Use Schedule E 1098 You can deduct mortgage interest on rental property as an expense of renting the property.

Homeowners who bought houses before December 16. Web The interest rate for estate tax changes annually. Rent supplement program for needy tenants living in privately owned housing.

Interest accrues daily on any unpaid principal. Web Student loan interest deduction Situations not covered. Heres how it works using an example property purchased for 325000 with a.

Web The rental property mortgage interest deduction offers significant tax benefits. During Afus 202122 income year 1 April 2021 to 31 March 2022 Afu. Web Real estate excise tax REET is a tax on the sale of real property.

The interest is calculated using. Web Mortgage Interest Deduction Qualified mortgage interest includes interest and points you pay on a loan secured by your main home or a second home. You report this mortgage.

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web We can deduct at least interest on 100000 as primary residence address and we get to deduct the rest on the rental or we can make an election to deduct it all. These expenses may include mortgage interest property tax.

All sales of real property in the state are subject to REET unless a specific exemption is claimed. Itemized deductions Unemployment income reported on a 1099-G Business or 1099-NEC income Stock sales. Compare offers from our partners side by side and find the perfect lender for you.

Web Essentially you may be able to deduct the interest of up to 100000 of the debt as well as 130th of the points each year assuming its a 30-year mortgage. Received 40000 from rental. See our interest rate table for current rates.

Web Afu has an interest-only mortgage of 500000 at a fixed rate of 3 per year.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Equity Meaning Formula Examples Calculation Importance

Can You Deduct Mortgage Interest On A Rental Property Youtube

How Federal Income Tax On Rental Properties Works Real Group Real Estate Chicago S Premier Residential Re Team

Free 9 Sample Rental Receipt Forms In Pdf Ms Word Excel

Solved Rental Income Below Fair Market Value

Can You Deduct Mortgage Interest On A Rental Property

Mortgage Interest Deduction Faqs Jeremy Kisner

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

Vacation Home Rentals And The Tcja Journal Of Accountancy

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Clause 44 Of Tax Audit Report Financepost

The Landlord S Guide To Deducting Rental Property Mortgage Interest Baselane

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Adjusted Gross Income Limitations For Rental Mortgage Interest

Tax Deductions On Home Loan Hra For Self Occupied House Property Mymoneysage Blog

Can You Deduct Mortgage Interest On A Rental Property Youtube